“You don’t have to swing hard to hit a home run. If you’ve got the timing, it’ll go.” – Yogi Berra

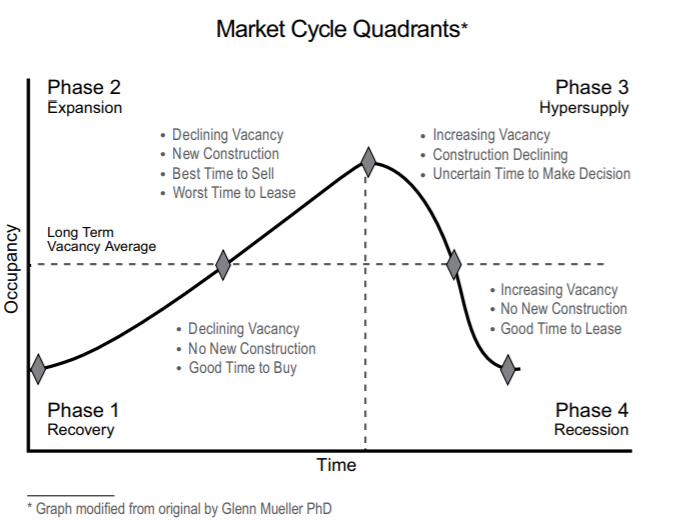

While we have all heard that the first rule in real estate is “location, location, location,” and I acknowledge its importance, I also believe that it is just as important to consider “timing, timing, timing.” Determining the best time to buy and sell for your specific situation depends on a multitude of factors, many of which are related to your specific industry and your unique personal and business requirements. Market cycles should always be considered in that equation because timing can mean the difference between making and losing millions. The best-case scenario for acquisition, disposition, and leasing is to understand and use market condition awareness in your favor by taking a strategic approach to timing your transactions, understanding where we currently are in the market cycle, and how that will potentially affect the outcome of the transaction. Also, integrating a market cycle analysis into your long-term strategy can significantly affect your wealth. While changes in your business may drive you into a scenario where you have no choice but to buy, sell, or lease, at a specific point in time, it is still important to understand how current market cycle conditions will affect your situation. To help decode the process for you, I have summarized the most common characteristics of the four distinct phases of the commercial real estate cycle: Recovery, Expansion, Hypersupply and Recession.

Recovery Phase

In the Recovery Phase, the market is improving, and prices and rents begin to increase, although many buyers and developers are still hesitant to proceed. More tenants enter the market and property owners refinance as affordable loan rates become available. Owners tend to improve their properties and work to maximize rental rates. Prices are increasing. This is a very good time to buy because there are still some relative bargains, and demand for space is definitely increasing. New construction is generally limited to build-to-suit, with little to no spec development.

Expansion Phase

During the Expansion Phase, the real estate market is improving and expanding, and equity investors are plentiful. Financing becomes more readily available and the price of real estate may increase more than seen in previous history. Vacancies move towards their lowest point and there is a general sense of well-being, prosperity, and abundance. “Everyone” is talking about buying real estate. This is the best time to sell and the worst time to lease. Rental rates will typically meet the “cost feasible rent rate” for spec development during the Expansion Phase.

Hypersupply Phase

The Hypersupply Phase is when vacancies are increasing, and prices begin to fall from the peak of the Expansion Phase. The market has become oversaturated and financing is again becoming less available and more expensive. Investors begin to withdraw from the market as vacancy and delinquency rates rise and prices decline. Foreclosures begin to increase, as some owners are unable to meet financing obligations due to vacancies. These are generally uncertain times and buying, selling, or leasing decisions should be based on specific business needs, unique prime property availability, and individual opportunities.

Recession Phase

The Recession Phase of the market cycle follows a market contraction from the peak of expansion and hyper-supply conditions. During this period, the availability of affordable financing dries up and property prices bottom out. Properties experience higher vacancy rates and owners are challenged to sell, lease, and finance their properties. We also start to see foreclosures increase in the marketplace. Indications that the market is moving out of recession can signal a good time to buy. Many times, property prices fall well below replacement cost, resulting in opportunities for investors with the liquidity and vision to capitalize on bargain prices. This is also one of the best times to lease a property.

Location is important; however, the timing of a lease or purchase is crucial to your decision. Before you make your next commercial real estate decision, make sure to include the current market cycle into your equation.

Want more tactical industrial real estate tips? Grab your copy of Warehouse Veteran today on Amazon! 100% of the proceeds from this book are pledged to support veteran-related causes such as the Intrepid Fallen Heroes Fund, Paws for Patriots, and the Fisher House Foundation. Every dollar you and others spend on purchasing this book and all related materials will go directly to fund veterans’ charitable organizations.

Would you like to speak with an experienced Real Estate Advisor? Contact Tampa Bay Industrial Advisors here and connect with us on Social Media!